Noble Gold Investments Review

Mike Stuzzi

In the face of rising inflation and market volatility, self-directed investors are increasingly seeking a hedge against these risks through physical precious metals. If you’re interested in knowing whether Noble Gold Investments is legit, you’ve come to the right place.

In my search for a reputable gold and silver IRA provider, I conducted an in-depth review of several companies offering these retirement products. Today I will share my findings on Noble Gold Investments.

As precious metals can provide an important diversification for IRA portfolios, it is crucial to vet any company handling such investments thoroughly. This Noble Gold review considered the company's products and services, trustworthiness, and fees - three pivotal factors in determining if they would be a suitable choice.

So, read on to discover whether this company suits you and your investment goals.

[kadence_element id="10532"]

Noble Gold Investments Overview

First in this Noble Gold review is general information about the company.

What Is Noble Gold Investments?

Noble Gold Investments is a leading precious metals IRA company that has helped Americans diversify their retirement portfolios with physical gold, silver, platinum, and palladium since 2016.

The company has an A+ rating from the Better Business Bureau (BBB) and was accredited in 2017. Also, it has over $1 billion in transactions since its founding date.

In other words, Noble Gold offers clients a trusted way to invest in hard assets outside of the traditional stock and bond markets. They provide personalized guidance to help you determine the right precious metals allocation for your individual needs and risk tolerance.

In addition to assisting with IRA transfers and rollovers, Noble Gold offers convenient purchase and delivery options. The company delivers physical coins and bars directly to customers' homes or businesses through its Noble Express program.

For those who prefer additional security for their gold IRAs, Noble Gold also facilitates segregated storage of metals in insured depositories. You can rest assured that your investment is in safe hands.

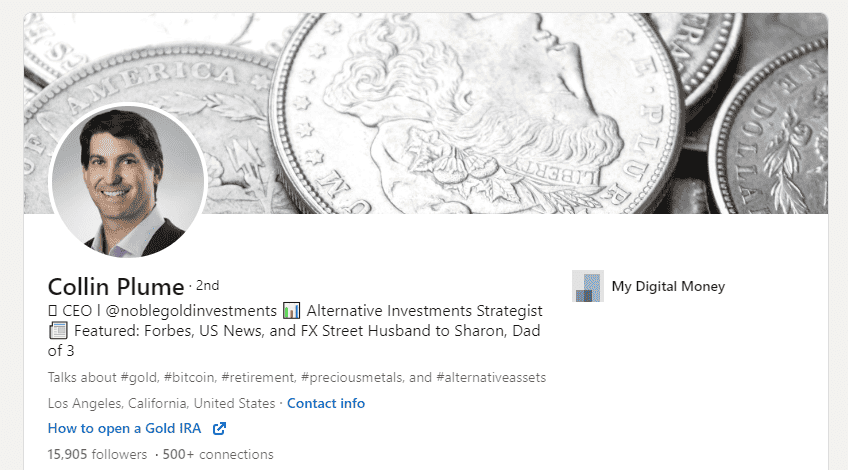

Who Is the Founder of Noble Gold Investments?

Noble Gold Investments was founded in 2016 by industry veterans Colin Plume and Charles Thorngren. Colin Plume is the company’s current president and owner.

He has accrued expertise across multiple sectors for more than 16 years. Before Noble Gold, he had successfully been involved in precious metals, property insurance, and real estate investment. Plume's extensive background in the gold market, spanning two decades, proved invaluable in launching Noble Gold's dedicated precious metals IRA platform.

Where Is Noble Gold Investments Located?

Noble Gold Investment is located in Los Angeles, California. The address is 16830 Ventura Blvd Ste 326, Encino, CA 91436, United States.

While their main office is in Encino, Noble Gold operates nationwide. They work with clients all around the U.S. who want to invest in gold or other precious metals.

How to Get Started with Noble Gold Investments

Here are the steps to get started with Noble Gold Investments in point form with more details:

- Complete the online application form on NobleGoldInvestments.com to open a self-directed Gold IRA. This takes just a few minutes.

- A dedicated Noble Gold representative will contact you to discuss your goals, risk tolerance, and time horizon. They will recommend suitable precious metal products.

- Choose your precious metal purchase - IRS-approved gold, silver, platinum, or palladium coins and bars in various denominations. Allocation depends on your strategy.

- Decide if you want to fund your IRA with a rollover from an existing retirement account or make a cash purchase. Rollovers are simple and have no tax penalties.

Starting is straightforward when working with a dedicated Noble Gold representative every step of the way. They simplify the process.

Your representative will guide you through the purchase and arrange for secure delivery and storage of your metals in an IRS-approved depository.

You can then sit back and watch your IRA grow as precious metals tend to hold value or appreciate over the long term. You’re free to rebalance as desired.

Noble Gold Investments Reviews and Ratings

Next up, let’s look at what Noble Gold’s online reputation looks like. The impressive thing is that even though the company has been in business for less than a decade.

Even so, it has managed to gather positive customer feedback on various review platforms, as shown:

- A+ rating on the BBB

- 4.98/5 stars from 145 customer reviews on the BBB

- 4.7 star rating and 119 reviews on Trustpilot

- 5 star rating and 732 reviews on Consumer Affairs

- 4.9 star rating and 454 reviews on Google Business

This goes to suggest that Noble Gold offers quality products and good customer service. These are two qualities that many other brands struggle to maintain.

Now, it’s not just regular users who talk positively about Noble Gold. Some celebrities endorse the company as well.

One notable figure is Charlie Kirk, an activist and radio talk show host. In his words, “...Noble Gold is the precious metals company I recommend to my friends and family.”

With high-profile supporters like Kirk vocalizing their trust in Noble Gold, the company has clearly established a respected reputation for protecting investments through precious metals.

Noble Gold Investments Buying Options

Like several other precious metal IRA companies I’ve reviewed, Noble Gold also offers two options for customers to choose from when investing:

- Gold or silver IRA

- Buying precious metals in cash

Gold or silver IRA

Noble Gold offers clients the ability to invest in precious metals through Individual Retirement Accounts, or IRAs. A gold or silver IRA allows you as an investor to hold physical precious metals in a tax-advantaged retirement fund, similar to how you would stocks or bonds.

Some of the qualified retirement accounts are 401(k), 403(b), 457(b), TSP, Roth, SEP, SIMPLE IRA, and some pensions (see list).

Setting up your precious metals IRA with Noble Gold turns out to be extremely straightforward. There’s a team of professionals who guide you step-by-step to make sure everything complies with IRS rules.

All transactions are handled according to IRS guidelines. With a Noble Gold IRA, you have the reassurance of knowing a portion of your long-term portfolio is backed by real and tangible assets rather than just market performance.

Buying Precious Metals in Cash

The second approach some consider is having the metals delivered directly to their home via Noble Gold's Noble Express program. It's reassuring to know that once an order is placed on the Noble Gold website, the gold or silver bars will arrive securely within a few days.

This avoids any need to transport physical gold or silver oneself. What’s even more, you get free insurance that protects the shipment in transit until it arrives at your door.

Another alternative that provides extra security is opting for Noble Gold's secure depository storage. Rather than receiving a delivery, the metals can be stored for the customer in their high-tech vaults.

Then if physical possession or a sale is ever needed, Noble Gold makes both simple to arrange. The peace of mind from knowing the precious metals are safely stored is worth the small annual fee.

Noble Gold Investments Products

Noble Gold offers a nice variety of precious metals for investors to choose from. In addition to the usual gold and silver, they also provide options for platinum and palladium.

This gives buyers more flexibility to tailor their portfolio to specific metals.

Bars

Noble Gold has bars available in different weights. Their gold bars come in 1-ounce, 10-ounce, and 1-kilogram sizes. Silver bars span from 1 ounce up to 1,000 ounces. And for those interested in platinum, they offer platinum bars as well.

All of their bars meet high purity standards of at least 999 fineness. This ensures you're getting investment-grade products. As an added perk, Noble Gold's bars are VAT-free so you avoid certain taxes.

Some top-quality brands they carry include PAMP Suisse gold bars, known for their beauty and reputation. Silver aficionados enjoy their Highland Mint bars.

Baird & Co. is a trusted name in the platinum space too. And, there are palladium bars as well from well-established names like Credit Suisse.

As you can see, Noble Gold’s selection of respected mints lets buyers choose from recognizable and investment-quality products. You can never go wrong.

Whether you want individual metals or a combination, Noble Gold has you covered. Bars provide a flexible way to hold precious metals yourself or contribute to a self-directed IRA.

Coins

In addition to bars, Noble Gold offers coins and rounds for precious metals investors. Their selection of gold coins includes classics like American Eagles, Canadian Maples, and Australian Kangaroos (which are government-issued bullion coins that are popular worldwide).

Silver coin enthusiasts can enjoy the selection of 35 to 90 percent "junk" silver coins along with modern bullion rounds and coins. Junk silver refers to U.S. dimes, quarters, and half dollars produced before 1965 when they contained actual silver content.

Noble Gold also carries platinum coins from reputable mints like the Royal Canadian Mint. And for those interested in diversifying with a rarer precious metal, they provide options in palladium coins too.

IRA-Eligible Coins

When it comes to diversifying your retirement portfolio with precious metals, it's important to choose investments that can be held within an IRA for tax advantages. Noble Gold understands this, which is why they maintain an extensive selection of coins approved by the IRS.

Some coin dealers sell primarily rare, collectible pieces that have numismatic value above their metal content. While fascinating to coin enthusiasts, these aren't always suitable for a retirement account.

Noble Gold avoids this issue by listing coins that the IRS considers "bullion-related" on its website, including mainstream minted gold and silver coins like American Eagles, Canadian Maples, and Austrian Philharmonics. By holding these IRA-approved coins, your gains and holdings remain tax-sheltered for the long run.

Rare Coins

On top of standard bullion coins and bars, Noble Gold has an impressive inventory of certified collectible coins for the true numismatist. They carefully curate rare and historic coins graded and authenticated by the most respected third-party experts in the field - NGC and PCGS.

Each collectible coin comes protected in its original plastic holder with the official grading label to preserve its condition and ensure authenticity. Noble Gold's team of coin authorities personally vets each piece to verify its history, eye appeal, and potential collectible value.

An example of highly sought-after coins that Noble Gold offers include early-1900s coins like the 4-piece Indian St. Gauden Set (MS63). Such coins only had production dates spanning less than 20 years, meaning there are fewer of them.

Whether you're a seasoned collector looking to upgrade a date in your set or just starting to appreciate numismatics, Noble Gold can guide you toward hand-picked certified coins primed for future appreciation. With prices often lower than a local coin shop, their selection of certified collectibles is truly best-in-class for the precious metals investor.

Noble Gold Investment Fees

Now, we look at the costs associated with the Noble Gold Investment gold IRA.

Minimum Investment

The minimum investment to get started with Noble Gold is $20,000. It isn’t the lowest minimum in the industry.

But it strikes a nice balance. It’s enough to meaningfully diversify into precious metals without too large of an upfront commitment.

Admin and Maintenance Fee

Like most gold IRA providers, Noble Gold does charge a nominal annual fee to cover the ongoing administration and maintenance of your account.

Specifically, their fee is $100 per year. This helps Noble Gold pay for activities like storage at their insured depository, regular audits to ensure your metals are accounted for, processing any transactions you request, and keeping your account documents up to date.

Compared to some other companies that can charge between $200 and $300 annually, Noble Gold's $100 fee is quite reasonable.

Storage Costs

In addition to the annual administration fee, Noble Gold also charges a separate fee to cover the secure storage of your precious metals holdings.

There are two storage options available:

- Non-segregated storage costs $100 per year. With this option, your metals are stored in Noble Gold's insured vault but not necessarily in your own segregated space.

- Segregated storage is more personalized at $150 annually. Here, your exact coins and bars are physically separated and identifiable as belonging solely to you. Some consider this extra layer of security worthwhile.

Noble Gold Investments Refunds

If you eventually decide to liquidate some or all of your precious metals holdings through Noble Gold, their buyback program provides an easy solution.

Rather than requiring you to find an outside buyer on your own, Noble Gold's buyback program guarantees they will repurchase the metals from your IRA. This simplifies the process and takes the guesswork out of locating a reputable purchaser.

When you initiate a buyback, Noble Gold provides a price quote based on that day's live spot prices for whatever metals you wish to sell. You can feel confident this price will be competitive, as they have an incentive to offer fair market value to facilitate future buybacks.

Noble Gold Investments Pros and Cons

Next on this Noble Gold IRA review is its pros and cons.

What I Like about Noble Gold

- The company has a rating of 5 stars on Consumer Affairs with hundreds of reviews

- Besides the usual gold and silver, Noble Gold offers palladium and platinum products, alongside rare coins for collectors

- Noble Gold gives you a free coin as a new investor

- There’s a guaranteed buyback program in case you need to sell in the future at good prices

What I Don’t Like About Noble Gold

- They have only one location listed online, unlike other companies with two or more

- The fees for gold and silver IRAs vary, with silver IRAs being costlier

Noble Gold and General Gold Investment FAQs

Is Noble Gold Investments Legit?

Given its good ratings and reviews online, you can rest assured that Noble Gold is among the most reputable gold IRA companies that exist. It’s even endorsed by big names like Charlie Kirk.

How Much Gold Do You Need to Buy?

You can go with Noble Gold’s minimum of $20,000 to start. Or, you can follow the advice of well-known investors like Paul Tudor Jones and Kevin O’Leary.

- Paul Tudor Jones - The billionaire hedge fund manager says he keeps around 5% of his total investments in gold at all times.

- Kevin O'Leary ("Mr. Wonderful" from Shark Tank) - He advocates maintaining a 5% gold position within an overall portfolio.

Some other factors that determine how much you can invest are risk tolerance, time horizon, whether or not you have other assets like real estate, financial goals, and income level.

Can You Store Gold at Home? Does Noble Gold Offer Home Delivery?

Yes, Noble Gold offers home delivery for precious metal purchases. When you buy physical gold or silver in cash through Noble Gold, they will ship your order discreetly and securely right to your home or office.

Noble Gold Investments Review 2024: Conclusion

Noble Gold offers a lot of benefits that make it an excellent choice - both for those just starting as well as more experienced traders.

Something to appreciate is how they provide a free gold or silver coin to fund your first IRA. Noble Gold effectively gives you your "toe in the water" without you paying a lot in minimum investment for precious metals.

It's a great way to get invested right away.

Noble Gold also offers an impressive variety of precious metal products that would be difficult to assemble yourself. They have all the standard gold and silver coins and bars.

Additionally, the company offers more rare items like limited mintage coins and collectibles - giving your portfolio valuable diversification.

Read also: