Revisão do Oxford Gold Group: BBB, classificações, ações judiciais e taxas

If you’re in the market for a gold IRA, chances are you’ve come across Oxford Gold Group as a potential provider. But how do you know if they’re truly trustworthy stewards of your retirement savings?

Rather than just falling for a company’s marketing tactics, looking deeper is essential. It helps to check out customer reviews, track records, and what experts say.

But worry no more. I conducted an in-depth evaluation of Oxford Gold Group for you to fully understand its credentials and reputation.

In this review, you’ll find Oxford Gold Group’s ratings with notable platforms like the Better Business Bureau. You’ll also discover details about any past lawsuits or complaints that could be red flags.

The goal is to help you make an informed decision by understanding Oxford Gold Group’s services, fees, and most importantly, how they’ve treated customers over the years.

By the end, you’ll have a clear-eyed view of both the potential pros and cons to carefully consider as you compare Oxford Gold Group to other options. Let’s begin our Oxford Gold review by taking a closer look at how they can serve you as an investor.

Leia também: Melhores empresas IRA de ouro e prata

Oxford Gold Group Overview

What Is Oxford Gold Group?

Oxford Gold Group is a full-service gold and precious metals IRA company that was founded in 2019. The company was founded by Patrick Granfar.

Oxford Gold Group is based in Beverly Hills, California. Their primary business is helping individuals invest in physical gold, silver, platinum, and palladium through self-directed individual retirement accounts (IRAs).

The company facilitates the purchase, storage, and sale of physical precious metals from IRS-approved depositories. This allows investors to hold tangible gold or silver in a tax-advantaged IRA.

Through their platform, you can learn a lot about precious metals investing in one place. You’ll get insights on gold IRA rollovers, how to set up an account, reasons to secure your investment, and more.

How Does Oxford Gold Group Work?

The first step is to schedule an initial informational call with an Oxford Gold Group account executive. Over the phone, the representative will discuss your financial goals and explain the benefits of investing in a gold IRA through their company. They can answer any questions you have about how OGG services work.

If you decide to move forward after learning more, the next phase is to transfer or roll over funds from an existing 401k or IRA to your new OGG account. As the IRA custodian, OGG will then take over management and record-keeping responsibilities for your retirement funds.

Once money is received into your account, you will select the precious metals to purchase. OGG works directly with major refineries and mints to offer gold coins, bars, and other bullion products in a variety of weights and denominations for you to choose from.

Your precious metals will then be securely stored in an IRS-approved depository on your behalf. OGG uses industry leaders for depository services, such as Brinks, which provides insurance against theft or damage.

Should you eventually want to sell metals or make additional contributions, OGG handles liquidations and new orders quickly and efficiently. Their representatives are also always available to assist you as your needs or the market changes over time.

Oxford Gold Group BBB and Other Ratings

Third-party reviews and accreditations help validate the legitimacy and customer service standards of a financial company. Oxford Gold Group has attained top-tier ratings across several important review platforms.

With the Better Business Bureau (BBB), Oxford Gold Group holds an A+ rating. The BBB awards ratings from A+ to F, with A+ being the highest possible score. Even more impressive, OGG has been an accredited BBB member since 2018, meaning it has undergone an application and review process.

- 4.94/5 stars BBB and an average of 96 customer reviews

- 4.7/5 rating and 185 reviews on Trustpilot

- 4.6/5 rating and 143 reviews on ConsumerAffairs

- 4.8/5 rating and 212 reviews on Google Business

These good ratings and reviews speak volumes about their ability to resolve issues and keep clients satisfied.

Oxford Gold Group Complaints

As of this writing, the BBB profile for Oxford Gold Group shows several complaints have been filed against the company in the last three years. However, all 19 of them are closed, meaning that the company resolved them.

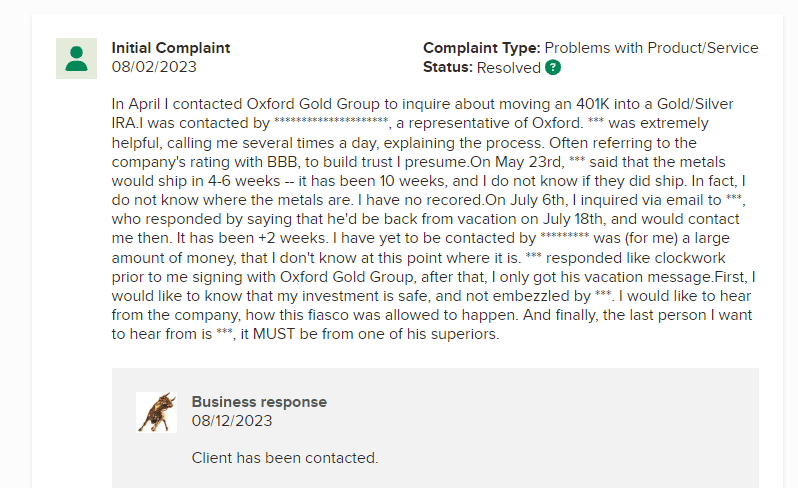

One of the most recent complaints on BBB was in late 2023. The customer contacted Oxford Gold Group to inquire about transferring their 401k into a gold/silver IRA. They were connected with a representative who was extremely helpful in the initial conversations.

Although the customer was told shipment takes 4 to 6 weeks, they had no record or knowledge of where the metals currently are after 10 weeks. The customer’s top concerns were ensuring their investment was safe and not potentially embezzled, and getting an explanation for how such poor communication was allowed to happen.

Oxford Gold has since resolved the matter. In other words, you can be sure that even if you face any problems, the company will assist you if you reach out to them.

More of the other resolved BBB complaints revolved around shipment delays and one regarding a slow buyback process. Also, there’s a customer noted that not being informed about a rep who has left the company may have contributed to the delays they experienced with account access.

Other than that, I went to Oxford Gold Group’s Google and Trustpilot pages to locate more complaints. I found the same issue with delays, with one user rating them 1 star on Trustpilot.

While shipment delays make up most of OGG’s complaints, logistical issues can sometimes arise even for reputable companies. It’s important to note that only a small minority appear to have experienced delays with Oxford Gold Group, based on the predominance of positive reviews.

Oxford Gold Group Lawsuit

Next on this Oxford Gold Group review, we move on to the lawsuits. Upon a quick search, I found a recent one of Gold Bull LLC vs. Oxford Gold Group, Inc. filed on December 8, 2023.

In summary, this is a trademark infringement lawsuit that has since moved past the initial pleadings stage with Oxford Gold Group filing their answer, and the court setting an initial scheduling conference to set litigation deadlines.

Given the last docket entry, the lawsuit against Oxford Gold Group remains ongoing and pending.

Oxford Gold Group Products and Services

Oxford Gold Group offers a variety of products and services, all involving investing your money into different precious metals.

Precious Metals IRA

Oxford Gold Group allows customers to invest in precious metals like gold, silver, platinum, and palladium through an individual retirement account (IRA). This is known as a self-directed precious metals IRA.

This type of account allows retirement funds to be diversified beyond traditional stocks and bonds into tangible precious metals. Diversification can help hedge against inflation and currency debasement.

Also, there are tax benefits to it. Contributions are made with pre-tax dollars and gains accumulate tax-deferred, just like a traditional IRA. Withdrawals in retirement are taxed as normal income.

Home Delivery

Oxford Gold Group offers a convenient home delivery service for customers who fund an account and purchase precious metals. With a funded account, you can browse various coins and bars to buy directly from OGG.

After making an order, delivery to your home or office address is free. This removes the need to store the tangible assets at a depository.

The good thing is that OGG ships precious metals in discreet, tamper-evident boxes via insured carriers. You have to sign the package for proof of delivery.

Precious Metal Bars

Oxford Gold Group offers a wide selection of precious metal bars for investors looking to directly hold physical bullion. Their gold bar lineup includes popular 1-ounce .9999 fine bars from major refiners like Credit Suisse and the Royal Canadian Mint.

This 1 oz size is ideal for smaller purchases and investments. Larger 10-ounce gold bars are also available, allowing investors to accumulate more gold in one bar while trading at a slight premium to the spot price per ounce due to their increased size.

In addition to gold, OGG provides silver bars in various sizes including 1-kilogram PAMP Suisse bars ideal for larger quantities of silver, as well as 1-ounce, 10-ounce, and 100-ounce bars from reputable mints. The larger silver bars have lower premiums per ounce.

Also available are quality platinum and palladium bars in sizes like 1 oz with varying thickness and manufacturers. These are difficult to find and you’ll have access to some of the rarest metals.

Gold, Silver, Platinum, and Palladium Coins

In addition to bars, OGG provides a wide selection of precious metal coins to suit all levels of experience. Beginners can purchase affordable government-issued silver bullion coins.

These include the American Silver Eagles and Canadian Maple Leafs. These 1 oz silver coins allow for more affordable purchases compared to larger denominations like 100 oz bars, while still providing exposure to physical silver in a liquid and recognizable format.

For gold coins, OGG stocks classic rounds and coins including American Gold Eagles, Canadian Gold Maples, Gold Buffalos, and Krugerrands. These are among the most globally recognized and widely traded bullion coins in the world.

OGG also has smaller 0.25 oz gold fractional coins for those dollar cost averaging. All coins are assayed by independent services to verify authenticity, purity, and grade.

Oxford Gold Group Minimum Investment and Fees

Investimento Mínimo

For those looking to open a self-directed gold IRA with OGG, the minimum initial investment is $7,500. This allows investors to take advantage of the tax benefits that come with holding eligible precious metals in an IRA.

If you wish to purchase physical gold, silver, platinum, or palladium outside of a retirement account, you can do so starting with just $1,500. This relatively low minimum provides access for new buyers to get started with a diversifying position in precious metals.

Both IRA and non-IRA investors have a wide selection of coins and bars to choose from to meet their minimum.

Tarifas

For self-directed IRA accounts holding less than $100,000, Oxford Gold charges an annual fee of $175. If an IRA exceeds $100,000 the annual fee increases to $225.

Even at this higher tier, OGG’s fees remain competitive compared to many other gold IRA custodians. These annual fees cover custodial, reporting, and administrative costs.

Oxford Gold Group Refund and Buyback Policy

Refund Policy

- Customers have 15 days from delivery to request a refund if unsatisfied with their purchase for any reason.

- The coins or bars must be in the original packaging and show no signs of tampering to qualify.

- OGG will either replace the items or fully refund the purchase price, allowing you to change your mind risk-free within two weeks.

Programa de recompra

- While OGG cannot legally guarantee future buyback prices, its voluntary program aims to provide liquidity to customers.

- To date, OGG has never refused to buy back properly stored metals from a client at the current market rate.

- Buyback pricing fluctuates daily with precious metals spot prices, so clients are advised to check for quotes before selling.

- Metals must meet quality standards to qualify for repurchase. OGG may apply storage or handling fees for items held in their vault for an extended time.

Together, these policies help protect you as an investor and give you options to either hold physical metals long-term or sell back to OGG depending on your goals and market conditions. The refund period also allows checking the asset class risk-free.

Oxford Gold Group Pros and Cons

Oxford Gold Group Pros

- Low investment minimum both for gold IRA and physical precious metal purchases

- Has a buyback program that although doesn’t guarantee repurchase, provides some peace of mind

- Offer a variety of products and services, including IRA-eligible coins and physical bars

Oxford Gold Group Cons

- Has some (resolved) complaints about delays in shipping

- You have to contact them for pricing

Oxford Gold Group Review: Conclusion

Oxford Gold Group remains a legitimate gold IRA company that can help start your precious metals investment journey. The low minimum to get started is a great benefit to both beginner and expert investors.

For beginners, you get a chance to invest an amount you can afford. If you’re experienced, it gives you a taste of what to expect before you can commit to investing more of your funds through the company.

Leia mais análises de ouro IRA:

- Avaliações, taxas, reclamações e ações judiciais da Augusta Precious Metals

- Revisão, classificações, investimento mínimo e taxas do American Harford Gold

- Análise, classificações, investimento mínimo e taxas de investimento da Noble Gold

- Preserve Gold Group Reviews, Fees, Complaints, and Lawsuits